Solutions

Insurance Companies

With deep expertise in Personal, Commercial, and Surplus Lines, we provide a comprehensive suite of technology and service offerings that optimize policy administration, improve underwriting accuracy, and enhance customer engagement. Our FOCUS on efficiency, scalability, and exceptional service helps carriers achieve their business goals while staying competitive in a dynamic market.

Managing General Agents (MGAs)

FOCUS delivers tailored technology and service solutions that streamline policy management, improve risk assessment, and enhance operational efficiency. We help MGAs scale their operations, expand market reach, and deliver superior customer service, all while driving profitability and supporting their unique business goals.

Insurance Start-ups

FOCUS empowers insurance startups with cutting-edge technology and expert services designed to simplify policy administration, improve risk management, and accelerate market entry. Our scalable solutions support rapid growth, operational efficiency, and compliance, helping startups navigate the complexities of the insurance landscape while achieving their business goals with agility and confidence.

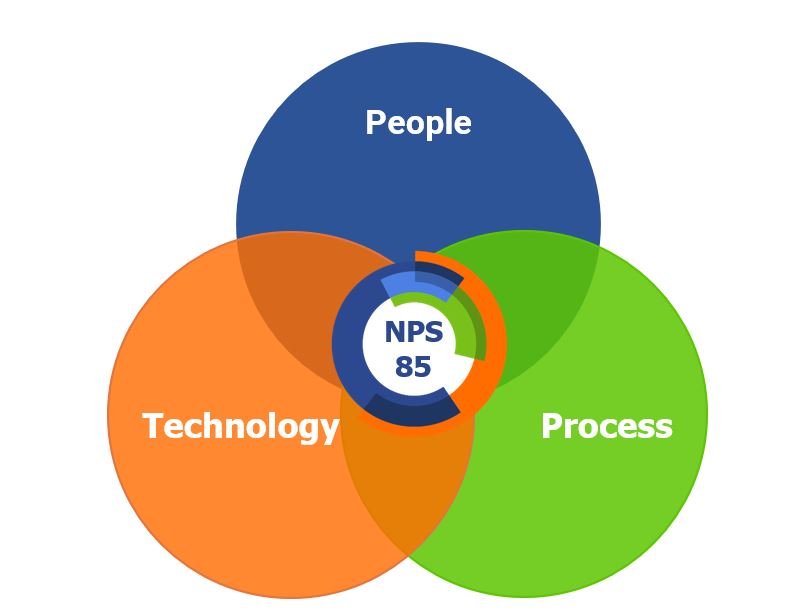

The FOCUS Difference

Consistent, Repeatable Success

Workflows that Scale Effortlessly

Rigorous Training and Management Programs

Our rigorous training and management programs empower teams with the knowledge and skills needed to excel. We FOCUS on operational excellence and customer service to ensure our clients maintain high performance and satisfaction levels.

Helped Build 16 Insurance Carriers

Implemented 25 Service Centers

FOCUS Solution Expertise

Full Data Access

Our clients benefit from complete access to their data, empowering them to make informed decisions, improve operational transparency, and optimize their business strategies based on real-time insights.

Exposure Management Expertise

Core Platform for High-Risk Areas

Book Rolls

Our team expertly handles book rolls, ensuring a seamless transfer of policies between carriers. We minimize disruption for agents and policyholders, streamline the process, and help clients expand their portfolios efficiently.

Florida Take Outs

The Work We Do

Case Study:Delivering Long-Term Value through Comprehensive Insurance Services

For over 30 years, FOCUS has maintained a strong, uninterrupted partnership with a leading insurer, dating back to the establishment of the insurer’s predecessor, the Florida Residential Property and Casualty Joint Underwriting Association (FRPCJUA) in 1993. Throughout this relationship, we have consistently provided essential insurance services and scalable solutions, particularly during periods of high demand and catastrophic events.

Key Achievements:

Underwriting Support:

High-Volume Task Processing:

In the past five years, we processed over 3.5 million tasks, including New Business Applications, Endorsements, Inspections, Cancellations, and Reinstatements. This operational efficiency allowed the insurer to FOCUS on strategic growth while maintaining exceptional service levels.

Call Center Expertise:

Catastrophe (CAT) Event Response:

Value Derived:

Key Achievements:

Exponential Growth Support:

Efficient Operations:

Technology-Driven Policy Administration:

Innovative Takeout Solutions:

Comprehensive Services:

Case Study:Driving Insurance Growth & Efficiency Through Tailored Solutions

In 2004, FOCUS partnered with senior management to establish a new insurance company from the ground up. Since then, we have been instrumental in supporting the insurer’s exponential growth to 120,000 policies in force. By leveraging our advanced technology and comprehensive insurance solutions, we’ve ensured their ongoing operational success.

Value Derived:

Case Study:Powering Small Commercial Market Entry with a 50-State Service Center

Key Achievements:

Comprehensive Market Support:

Operational Efficiency:

Call Center Expertise:

Value Derived:

Key Achievements:

Growth Support:

Operational Efficiency:

System Flexibility

Expert Underwriting:

Core Platform & BPO Services:

Case Study:Accelerating Growth for a New Insurer in the P&C Market

Since 2019, FOCUS has been a key partner in supporting an emerging insurer’s rapid growth from inception to over 35,000 policies in force. Through our comprehensive solutions, we provide the core platform and a full suite of BPO services, helping the insurer scale operations and expand their market presence.